Doing Business records the taxes and mandatory contributions that a medium-size company must pay in a given year as well as measures of the administrative burden of paying taxes and contributions and complying with postfiling procedures. The project was developed and implemented in cooperation with PwC. Taxes and contributions measured include the profit or corporate income tax, social contributions and labor taxes paid by the employer, property taxes, property transfer taxes, dividend tax, capital gains tax, financial transactions tax, waste collection taxes, vehicle and road taxes, and any other small taxes or fees.

The ranking of economies on the ease of paying taxes is determined by sorting their scores for paying taxes. These scores are the simple average of the scores for each of the component indicators, with a threshold and a nonlinear transformation applied to one of the component indicators, the total tax and contribution rate. The threshold is defined as the total tax and contribution rate at the 15th percentile of the overall distribution for all years included in the analysis up to and including Doing Business 2015, which is 26.1%. All economies with a total tax and contribution rate below this threshold receive the same score as the economy at the threshold.

The threshold is not based on any economic theory of an “optimal tax rate” that minimizes distortions or maximizes efficiency in an economy’s overall tax system. Instead, it is mainly empirical in nature, set at the lower end of the distribution of tax rates levied on medium-size enterprises in the manufacturing sector as observed through the paying taxes indicators. This reduces the bias in the total tax and contribution rate indicator toward economies that do not need to levy significant taxes on companies like the Doing Business standardized case study company because they raise public revenue in other ways—for example, through taxes on foreign companies, through taxes on sectors other than manufacturing or from natural resources (all of which are outside the scope of the methodology).

Doing Business measures all taxes and contributions that are government mandated (at any level—federal, state or local) and that apply to the standardized business and have an impact in its financial statements. In doing so, Doing Business goes beyond the traditional definition of a tax. As defined for the purposes of government national accounts, taxes include only compulsory, unrequited payments to general government. Doing Business departs from this definition because it measures imposed charges that affect business accounts, not government accounts. One main difference relates to labor contributions. The Doing Business measure includes government-mandated contributions paid by the employer to a requited private pension fund or workers’ insurance fund. It includes, for example, Australia’s compulsory superannuation guarantee and workers’ compensation insurance. For the purpose of calculating the total tax and contribution rate (defined below), only taxes borne are included. For example, value added taxes (VAT) are generally excluded (provided that they are not irrecoverable) because they do not affect the accounting profits of the business—that is, they are not reflected in the income statement. They are, however, included for the purpose of the compliance measures (time and payments), as they add to the burden of complying with the tax system.

Doing Business uses a case scenario to measure the taxes and contributions paid by a standardized business and the complexity of an economy’s tax compliance system. This case scenario uses a set of financial statements and assumptions about the transactions made over the course of the year. In each economy tax experts from a number of different firms (in many economies these include PwC) compute the taxes and mandatory contributions due in their jurisdiction based on the standardized case study facts. Information is also compiled on the frequency of filing and payments, the time taken to comply with tax laws in an economy, the time taken to request and process a VAT refund claim and the time taken to comply with and complete a corporate income tax correction. To make the data comparable across economies, several assumptions about the business and the taxes and contributions are used.

Assumptions about the business

The business:

- Is a limited liability, taxable company. If there is more than one type of limited liability company in the economy, the limited liability form most common among domestic firms is chosen. The most common form is reported by incorporation lawyers or the statistical office.

- Started operations on January 1, 2017. At that time the company purchased all the assets shown in its balance sheet and hired all its workers.

- Operates in the economy’s largest business city. For 11 economies the data are also collected for the second largest business city.

- Is 100% domestically owned and has five owners, all of whom are natural persons.

- At the end of 2017, has a start-up capital of 102 times income per capita.

- Performs general industrial or commercial activities. Specifically, it produces ceramic flowerpots and sells them at retail. It does not participate in foreign trade (no import or export) and does not handle products subject to a special tax regime, for example, liquor or tobacco.

- At the beginning of 2018, owns two plots of land, one building, machinery, office equipment, computers and one truck and leases one truck.

- Does not qualify for investment incentives or any benefits apart from those related to the age or size of the company.

- Has 60 employees — 4 managers, 8 assistants and 48 workers. All are nationals, and one manager is also an owner. The company pays for additional medical insurance for employees (not mandated by any law) as an additional benefit. In addition, in some economies reimbursable business travel and client entertainment expenses are considered fringe benefits. When applicable, it is assumed that the company pays the fringe benefit tax on this expense or that the benefit becomes taxable income for the employee. The case study assumes no additional salary additions for meals, transportation, education or others. Therefore, even when such benefits are frequent, they are not added to or removed from the taxable gross salaries to arrive at the labor tax or contribution calculation.

- Has a turnover of 1,050 times income per capita.

- Makes a loss in the first year of operation.

- Has a gross margin (pretax) of 20% (that is, sales are 120% of the cost of goods sold).

- Distributes 50% of its net profits as dividends to the owners at the end of the second year.

- Sells one of its plots of land at a profit at the beginning of the second year.

- Is subject to a series of detailed assumptions on expenses and transactions to further standardize the case. For example, the owner who is also a manager spends 10% of income per capita on traveling for the company (20% of this owner’s expenses are purely private, 20% are for entertaining customers, and 60% are for business travel). All financial statement variables are proportional to 2012 income per capita (this is an update from Doing Business 2013 and previous years’ reports, where the variables were proportional to 2005 income per capita). For some economies a multiple of two or three times income per capita has been used to estimate the financial statement variables. The 2012 income per capita was not sufficient to bring the salaries of all the case study employees up to the minimum wage thresholds that exist in these economies.

Assumptions about the taxes and contributions

- All the taxes and contributions recorded are those paid in the second year of operation (calendar year 2018). A tax or contribution is considered distinct if it has a different name or is collected by a different agency. Taxes and contributions with the same name and agency, but charged at different rates depending on the business, are counted as the same tax or contribution.

- The number of times the company pays taxes and contributions in a year is the number of different taxes or contributions multiplied by the frequency of payment (or withholding) for each tax. The frequency of payment includes advance payments (or withholding) as well as regular payments (or withholding).

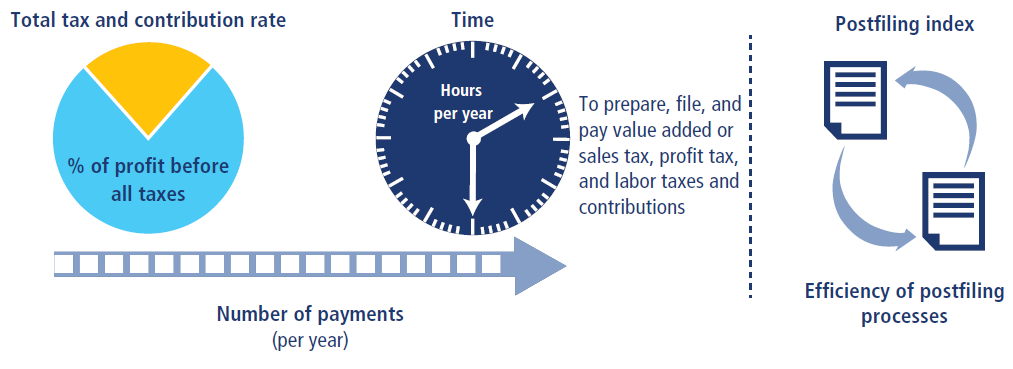

Tax payments

The tax payments indicator reflects the total number of taxes and contributions paid, the method of payment, the frequency of payment, the frequency of filing and the number of agencies involved for the standardized case study company during the second year of operation. It includes taxes withheld by the company, such as sales tax, VAT and employee-borne labor taxes. These taxes are traditionally collected by the company from the consumer or employee on behalf of the tax agencies. Although they do not affect the income statements of the company, they add to the administrative burden of complying with the tax system and so are included in the tax payments measure.

The number of payments takes into account electronic filing. Where full electronic filing and payment is allowed and it is used by the majority of medium-size businesses, the tax is counted as paid once a year even if filings and payments are more frequent. For payments made through third parties, such as tax on interest paid by a financial institution or fuel tax paid by a fuel distributor, only one payment is included even if payments are more frequent.

Where two or more taxes or contributions are filed for and paid jointly using the same form, each of these joint payments is counted once. For example, if mandatory health insurance contributions and mandatory pension contributions are filed for and paid together, only one of these contributions would be included in the number of payments.

Time

Time is recorded in hours per year. The indicator measures the time taken to prepare, file and pay three major types of taxes and contributions: the corporate income tax, value added or sales tax, and labor taxes, including payroll taxes and social contributions. Preparation time includes the time to collect all information necessary to compute the tax payable and to calculate the amount payable. If separate accounting books must be kept for tax purposes—or separate calculations made—the time associated with these processes is included. This extra time is included only if the regular accounting work is not enough to fulfill the tax accounting requirements. Filing time includes the time to complete all necessary tax return forms and file the relevant returns at the tax authority. Payment time considers the hours needed to make the payment online or in person. Where taxes and contributions are paid in person, the time includes delays while waiting.

Total tax and contribution rate

The total tax and contribution rate measures the amount of taxes and mandatory contributions borne by the business in the second year of operation, expressed as a share of commercial profit. Doing Business 2020 reports the total tax and contribution rate for calendar year 2018. The total amount of taxes and contributions borne is the sum of all the different taxes and contributions payable after accounting for allowable deductions and exemptions. The taxes withheld (such as personal income tax) or collected by the company and remitted to the tax authorities (such as VAT, sales tax or goods and service tax) but not borne by the company are excluded. The taxes included can be divided into five categories: profit or corporate income tax, social contributions and labor taxes paid by the employer (for which all mandatory contributions are included, even if paid to a private entity such as a requited pension fund), property taxes, turnover taxes and other taxes (such as municipal fees and vehicle taxes). Fuel taxes are no longer included in the total tax and contribution rate because of the difficulty of computing these taxes in a consistent way for all economies covered. The fuel tax amounts are in most cases very small, and measuring these amounts is often complicated because they depend on fuel consumption. Fuel taxes continue to be counted in the number of payments.

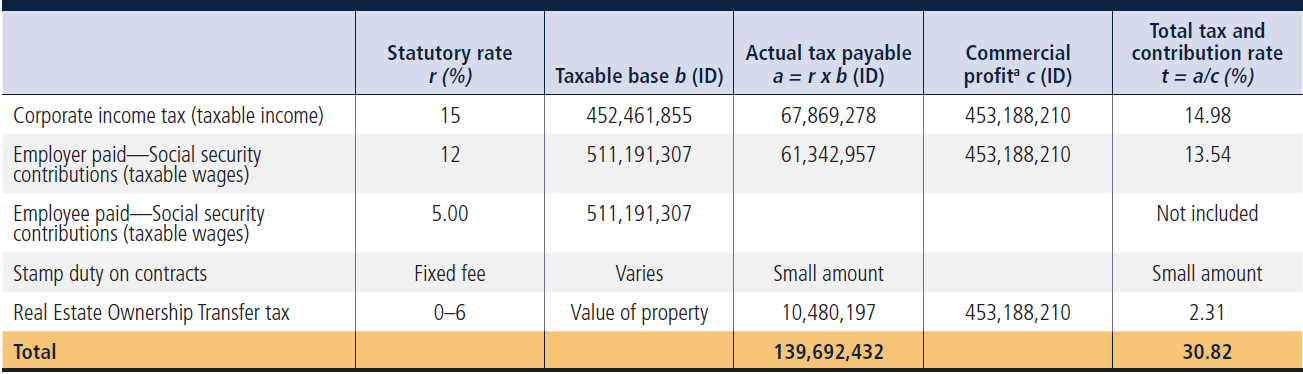

The total tax and contribution rate is designed to provide a comprehensive measure of the cost of all the taxes a business bears. It differs from the statutory tax rate, which merely provides the factor to be applied to the tax base. In computing the total tax and contribution rate, the actual tax or contribution payable is divided by commercial profit. Data for Iraq are provided as an example (table 1).

Note: Commercial profit is assumed to be 59.4 times income per capita. ID is Iraqi dinar.

*Profit before all taxes borne

Commercial profit is essentially net profit before all taxes and contributions borne. It differs from the conventional profit before tax, reported in financial statements. In computing profit before tax, many of the taxes borne by a firm are deductible. In computing commercial profit, these taxes are not deductible. Commercial profit therefore presents a clear picture of the actual profit of a business before any of the taxes it bears in the course of the fiscal year.

Commercial profit is computed as sales minus cost of goods sold, minus gross salaries, minus administrative expenses, minus other expenses, minus provisions, plus capital gains (from the property sale) minus interest expense, plus interest income and minus commercial depreciation. To compute the commercial depreciation, a straight-line depreciation method is applied, with the following rates: 0% for the land, 5% for the building, 10% for the machinery, 33% for the computers, 20% for the office equipment, 20% for the truck and 10% for business development expenses. Commercial profit amounts to 59.4 times income per capita.

Note: ALL is Albanian lek.

Doing Business focuses on a case study for a standardized medium- size company.

The postfiling index is based on four components—time to comply with VAT refund, time to obtain VAT refund, time to comply with a corporate income tax correction and time to complete a corporate income tax correction. If both VAT and corporate income tax apply, the postfiling index is the simple average of the scores for each of the four components. If only VAT or corporate income tax applies, the postfiling index is the simple average of the scores for only the two components pertaining to the appli- cable tax. If neither VAT nor corporate income tax applies, the postfiling index is not included in the ranking of the ease of paying taxes.

The four components include the time to comply with and complete a tax audit when applicable (see details below). The definition of a tax audit includes any interaction between the taxpayer and the tax authority post filing of the tax return and payment of the tax liability due, including informal inquiries, formal inquiries and formal tax audits to verify whether such taxpayers have correctly assessed and reported their tax liability and fulfilled other obligations.

The indicators are based on expanded case study assumptions.

Assumptions about the VAT refund process

- In June 2018, TaxpayerCo. makes a large capital purchase: one additional machine for manufacturing pots.

- The value of the machine is 65 times income per capita of the economy.

- Sales are equally spread per month (that is, 1,050 times income per capita divided by 12).

- Cost of goods sold are equally expensed per month (that is, 875 times income per capita divided by 12).

- The seller of the machinery is registered for VAT.

- Excess input VAT incurred in June will be fully recovered after four consecutive months if the VAT rate is the same for inputs, sales and the machine and the tax reporting period is every month.

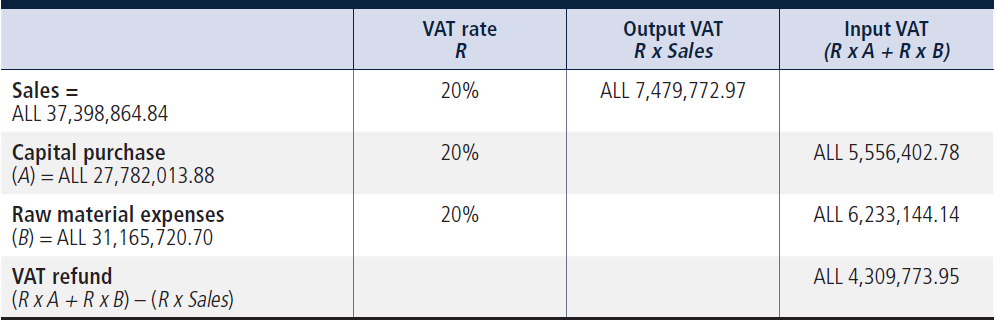

- Input VAT will exceed output VAT in June 2018 (table 3).

Assumptions about the corporate income tax correction process

- An error in the calculation of the income tax liability (for example, use of incorrect tax depreciation rates, or incorrectly treating an expense as tax deductible) leads to an incorrect income tax return and consequently an underpayment of corporate income tax.

- TaxpayerCo. discovered the error and voluntarily notified the tax authority of the error in the corporate income tax return.

- The value of the underpaid income tax liability is 5% of the corporate income tax liability due.

- TaxpayerCo. submits the corrected information after the deadline for submitting the annual tax return, but within the tax assessment period.

Time to comply with VAT refund

Time is recorded in hours. The indicator has two parts:

- The process of claiming a VAT refund. Time includes: time spent by TaxpayerCo. on gathering VAT information from internal sources, including time spent on any additional analysis of accounting informa- tion and calculating the VAT refund amount; time spent by TaxpayerCo. on preparing the VAT refund claim; time spent by TaxpayerCo. preparing any additional documents that are needed to substantiate the claim for the VAT refund; time spent submitting the VAT refund claim and additional documents if that submission is done separately from the submission of the standard VAT return; time spent making representation at the tax office if required; and time spent by TaxpayerCo. completing any other mandatory activities or tasks associated with the VAT refund (table 3).

- The process of a VAT audit. This is captured if companies with a request for a VAT cash refund due to a capital purchase are pooled into additional review in 50% or more of cases. Time includes: time spent by TaxpayerCo. on gathering information and preparing any documentation (information such as receipts, financial statements, pay stubs) as required by the tax auditor; time spent by TaxpayerCo. on submitting the documents requested by the auditor.

A total estimate of zero hours is recorded if the process of claiming a VAT refund is done automatically within the standard VAT return without the need to complete any additional section or part of the return, no additional documents or tasks are required as a result of the input tax credit and, in 50% or more of similar cases, the company is not subjected to an audit.

An estimate of half an hour is recorded for submission of documents if the submission is done electronically and is a matter of minutes. An estimate of zero hours is recorded in the case of a field audit if documents are submitted in person and at the taxpayer’s premises.

In Kosovo, for example, taxpayers spend 27 hours complying with the process of claiming a VAT refund. Taxpayers request the VAT refund in the standard VAT return. Taxpayers spend two hours gathering information from internal sources and accounting records to calculate the amount of the VAT refund. There is no additional time for preparing the refund claim because taxpayers indicate in the online VAT return that they want the outstanding VAT balance to be refunded. Taxpayers must also prepare and have available for review all purchase and sales invoices for the past three months, a business explanation of VAT overpayment for large purchases or investments, bank statements, any missing tax declaration and a copy of fiscal and VAT certificates. Taxpayers spend four hours preparing these additional documents. These documents are submitted electronically at the same time as the submission of the VAT return. Taxpayers must also appear in person at the tax office to explain the VAT refund claim and the reasons for the excess input VAT in the month of June. This takes three hours. Additionally, the claim for a VAT refund would trigger a full audit at the tax office. Taxpayers spend 16 hours preparing the documents requested by the auditor including purchase and sales invoices, bills, bank transactions, records on accounting software, tax returns and contracts. Taxpayers submit the documents to the auditor in person at the tax office (two hours for submission).

Time to obtain VAT refund

Time is recorded in weeks. Time measures the total waiting time to receive a VAT refund from the moment the request has been submitted. If companies with a request for a VAT cash refund due to a capital purchase are pooled into additional review in 50% or more of cases, time includes time to start the audit from the moment of claiming the VAT refund, time spent by TaxpayerCo. interacting with the auditor from the moment an audit begins until there are no further interactions between TaxpayerCo. and the auditor (including the various rounds of interactions between TaxpayerCo. and the auditor), time spent waiting for the tax auditor to issue the final audit decision from the moment TaxpayerCo. has submitted all relevant information and documents and there are no further interactions between TaxpayerCo. and the auditor and time spent waiting for the release of the VAT refund payment from the moment the final audit decision has been issued by the auditor.

Time also includes an average waiting time to submit the refund claim. The average waiting time to submit the refund claim is half a month if the VAT refund claim is filed monthly. The average waiting time to submit the refund claim is one month if the VAT refund claim is filed bimonthly. The average waiting time to submit the refund claim is one and a half months if the VAT refund claim is filed quarterly. The average waiting time to submit the refund claim is three months if the VAT refund claim is filed semi-annually. The average waiting time to submit the refund claim is six months if the VAT refund claim is filed annually.

Time includes the mandatory carry forward time before a VAT refund in cash can be paid. The carry forward time is zero if there is no mandatory carry forward period.

In Albania, for example, it takes 37 weeks to receive a VAT refund. The request for a VAT refund triggers an audit by the tax authorities. It takes four weeks for the tax authority to start the audit. Taxpayers spend 8.6 weeks interacting with the auditor and wait four weeks until the final assessment is issued. Taxpayers only receive the VAT refund after the audit is completed. Taxpayers wait five weeks for the release of the VAT refund payment. In Albania the taxpayers must carry forward the VAT refund for three consecutive VAT accounting periods (three months in the case of Albania) before a refund in cash is requested. The three months (13 weeks) carry forward period is included in the total time to receive a VAT refund. The VAT return is filed monthly and thus 0.5 month (2.1 weeks) is included in the total time to receive a VAT refund.

If an economy does not have a VAT, the economy will not be scored on the two indicators for a VAT refund process— time to comply with VAT refund and time to obtain VAT refund. This is the case in Bahrain. If an economy has a VAT and the purchase of a machine is not subject to VAT, the economy will not be scored on time to comply with VAT refund and time to obtain VAT refund. This is the case in Sierra Leone. If an economy has a VAT that was introduced in calendar year 2018 and there is not sufficient data to assess the refund process, the economy will not be scored on time to comply with VAT refund and time to obtain VAT refund.

If an economy has a VAT but the ability to claim a refund is restricted to specific categories of taxpayers that do not include the case study company, the economy is assigned a score of 0 for time to comply with VAT refund and time to obtain VAT refund. In Bolivia, for example, only exporters are eligible to request a VAT refund. As a result, Bolivia receives a score of 0 for time to comply with VAT refund and time to obtain VAT refund. If an economy has a VAT and the case study company is eligible to claim a refund but cash refunds do not occur in practice, the economy is assigned a score of 0 for time to comply with VAT refund and time to obtain VAT refund. This is the case in Central African Republic. If an economy has a VAT but there is no refund mechanism in place, the economy is assigned a score of 0 for time to comply with VAT refund and time to obtain VAT refund. This is the case in Sudan. If an economy has a VAT but input tax on a capital purchase is a cost on the business, the economy is scored 0 for time to comply with VAT refund and time to obtain VAT refund. This is the case in Myanmar.

Time to comply with a corporate income tax correction

Time is recorded in hours. The indicator has two parts:

- The process of notifying the tax authorities of the error, amending the return and making additional payment. Time includes: time spent by TaxpayerCo. gathering information and preparing the documents required to notify the tax authorities; time spent by TaxpayerCo. in submitting the documents; and time spent by TaxpayerCo. in making the additional tax payment if the payment is done separately from the submission of the amended corporate income tax return.

- The process of complying with a corporate income tax correction. This is captured if, in 25% or more of cases, the pool of companies that were exposed to additional review included companies that self-reported an error in the corporate income tax return, which resulted in their owing more in corporate income tax because of underpayment. The threshold used for assessing the corporate income tax audit is lower than the threshold used in the case of the VAT cash refund. This is because the case study scenario of self-reporting an error in the corporate income tax return and resulting in an underpayment of the tax liability should only be an issue among a small sample of companies selected for a tax audit. Unlike a corporate income tax correction, it is common that a one-time request for a VAT cash refund be exposed to a tax audit. Time includes time spent by TaxpayerCo. gathering information and preparing any documentation (information such as receipts, financial statements, pay stubs) as required by the tax auditor, and time spent by TaxpayerCo. submitting the documents requested by the auditor.

An estimate of half an hour is recorded for submission of documents or payment of the income tax liability due if the submission or payment is done electronically in several minutes. An estimate of zero hours is recorded in the case of a field audit if documents are submitted in person and at the taxpayer’s premises.

In the Slovak Republic, for example, taxpayers would submit an amended corporate income tax return electronically. It takes taxpayers one hour to correct the error in the return, half an hour to submit the amended return online and half an hour to make the additional payment online. Amending a corporate income tax return per the case study scenario in the Slovak Republic would not be subject to additional review. This brings the total compliance time to two hours.

Time to complete a corporate income tax correction

Time is recorded in weeks. Time includes the time to start an audit from the moment the tax authority has been notified of the error in the corporate income tax return, time spent by TaxpayerCo. interacting with the auditor from the moment an audit begins until there are no further interactions between TaxpayerCo. and the auditor (including the various rounds of interactions between TaxpayerCo. and the auditor), and time spent waiting for the tax auditor to issue the final tax assessment from the moment TaxpayerCo. has submitted all relevant information and documents and there are no further interactions between TaxpayerCo. and the auditor.

Time to complete a corporate income tax correction is recorded as zero if less than 25% of companies will not go through an additional review.

In Switzerland, for example, taxpayers with an amended corporate income tax return per the case study scenario are subject to a single-issue audit conducted at the taxpayer’s premises. Taxpayers wait 30 days (4.28 weeks) until the tax authority starts the audit and interact for a total of four days (0.57 weeks) with the auditor and wait for four weeks until the final assessment is issued by the auditor, resulting in a total of 8.86 weeks to complete a corporate income tax correction.

If an economy does not levy corporate income tax, the economy will not be scored on the two indicators: time to comply with a corporate income tax correction and time to complete a corporate income tax correction. This is the case in Vanuatu.

An economy receives a “no practice” mark on the payments, time, total tax and contribution rate and postfiling index indicators if the economy does not levy any taxes or mandatory contributions.

Reforms

The paying taxes indicator set tracks changes related to the different taxes and mandatory contributions that a medium-size company must pay in a given year, the administrative burden of paying taxes and contributions and the administrative burden of complying with two postfiling processes (VAT refund, and tax audit) per calendar year. Depending on the impact on the data, certain changes are classified as reforms and listed in the summaries of Doing Business reforms in order to acknowledge the implementation of significant changes. Reforms are divided into two types: those that make it easier to do business and those changes that make it more difficult to do business. The paying taxes indicator set uses one criterion to recognize a reform.

The impact of data changes is assessed based on the absolute change in the overall score of the indicator set as well as the change in the relative score gap. Any data update that leads to a change of 0.5 points or more in the score and 2% or more on the relative score gap is classified as a reform, except when the change is the result of automatic official fee indexation to a price or wage index (for more details, see the chapter on the ease of doing business score and ease of doing business ranking). For example, if the implementation of a new electronic system for filing or paying one of the three major taxes (corporate income tax, VAT and labor taxes including mandatory contributions) reduces time or the number of payments in a way that the score increases by 0.5 points or more and the overall gap decreases by 2% or more, the change is classified as a reform. Minor updates to tax rates or fixed charges or other smaller changes in the indicators that have an aggregate impact of less than 0.5 points on the overall score or 2% on the gap are not classified as a reform, but the data are updated accordingly.

When an economy introduces a value added tax or sales tax, the reform is classified as a neutral reform even though this type of reform increases the administrative burden on firms.

This methodology was developed by Djankov and others (2010).